CoolCare’s latest lively roundtable discussion brought together four care industry experts from across the sector, to share their insights into the outlook for residential care providers. With extensive experience in care home construction, operations and funding, the panellists were able to look to the future and what the sector needs to do to carve-out positive opportunities from the crisis.

With the immediate crisis in occupancy now passing, the panellists concluded that the next challenge to overcome is giving confidence to those seeking care for their loved one. Demonstrating and communicating the ability to manage any future outbreaks through the built environment, as well as systems and processes in place, will be vital for giving necessary reassurance to enquirers alongside both regulators and funders. At the heart of this will be well-designed care facilities and effective utilisation of technology. The market remains an attractive proposition to the investment community, but to coin the cliché(!), it is very much a tale of two cities.

The panel painted a hopeful and positive picture, setting out how the care home sector can rise to the challenges ahead through resilience and agility, and throughout the session attendees shared their views by answering our poll questions.

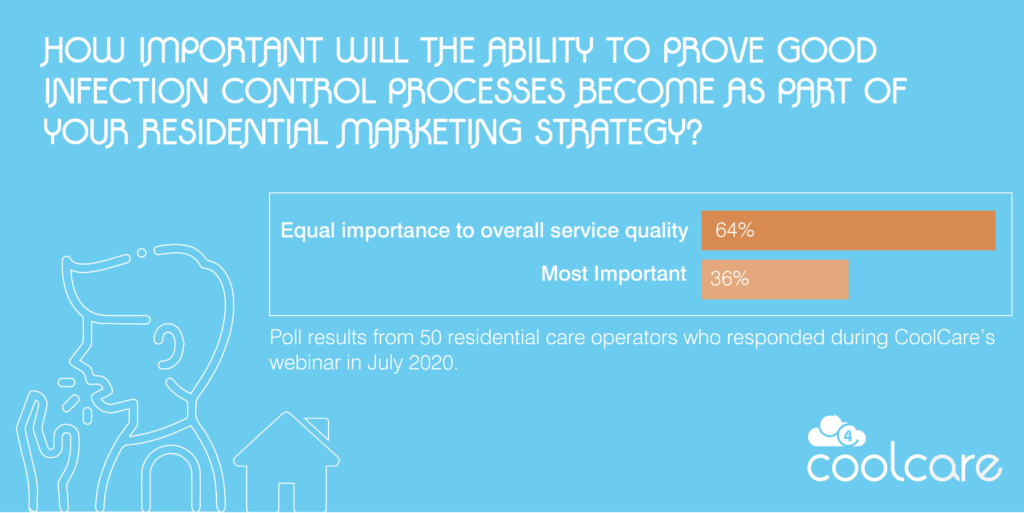

Poll #1 Answers:

built environment and future operating models.

Interestingly, despite the heavy blow COVID19 has had on occupancy, cost escalation and staffing shortages, our panellists’ experience showed that the appetite to grow and invest in residential assets remains healthy. Target’s Head of Investment, John Flannelly kicked-off the discussion with his observation that the crisis is going to accelerate the trends we are already seeing in terms of the built environment:

Interestingly, despite the heavy blow COVID19 has had on occupancy, cost escalation and staffing shortages, our panellists’ experience showed that the appetite to grow and invest in residential assets remains healthy. Target’s Head of Investment, John Flannelly kicked-off the discussion with his observation that the crisis is going to accelerate the trends we are already seeing in terms of the built environment:

“There has been increasing departure from the market of the older converted smaller properties which, even pre-COVID, were more challenging to operate effectively and efficiency…In 2014, 14% of the beds had wetroom ensuites – in 2020, that’s 26%.”

Most importantly, John felt the built environment is going to hold the key to occupancy recovery too, “[It] will be more of a focus for those families that are purchasing care beds for their mum or dad, who will be considering the ability of the home to handle another pandemic or outbreak”.

The fight back may literally start with care homes’ foundations, as the built environment holds the key to solving many of the issues that care homes have had to deal with. The focus will fall to the design, rather than the number of beds, with specific extra attention on areas such as ventilation, ability to self-isolate and even adapting communal meeting areas so social distancing can take place.

Following his experience of managing a varied portfolio through COVID19, CFO of Country Court Care, Al-Karim Kachra (AK) agreed that the ability to isolate and the layout of the home had proved key to managing COVID well in Country Court Care’s facilities. Whilst that tends to go hand-in-hand with the new and larger homes, he added: “That’s not to say it has to be big and new but is very much about the home layout and the ability to isolate and adapt.” He commented that, a smaller 30 bed home can still be viable, so long as the fee and acuity levels of home are balanced to support the increased costs of operation associated with PPE etc. This will typically be more difficult in a smaller facility but not unmanageable.

These views were echoed by Matt Lowe who added his perspective as both a care home developer through LNT Care Development and an operator with Ideal  Carehomes. He added that from a build perspective, there are some simple changes around ventilation and provision of day spaces, which are being driven by the operational changes required during COVID. Many of these changes are not ground-breaking but have proved of heightened importance for infection control purposes, such as incorporating in/out ventilation systems rather than a ducted system that runs from room to room which will feature in new builds going forward.

Carehomes. He added that from a build perspective, there are some simple changes around ventilation and provision of day spaces, which are being driven by the operational changes required during COVID. Many of these changes are not ground-breaking but have proved of heightened importance for infection control purposes, such as incorporating in/out ventilation systems rather than a ducted system that runs from room to room which will feature in new builds going forward.

The panel were all in agreement that there will be a need to manage resident isolation for the short to medium-term future and homes will need to be able to adapt to these needs, zoning the property according to needs. Not only will it be influential to families, but is also likely to have a significant bearing on local authority contract decisions.

Halycon Care’s Mike Whitehead rounded-up the discussion by concluding that built environments will need to change and were tweaks can be made to existing assets, these changes will need to be accommodated: “Things that were previously just design spec details, such as trickle vents etc., are now actually selling points…I don’t think that [double occupancy] rooms are going to be something that will be fundable going forward.”

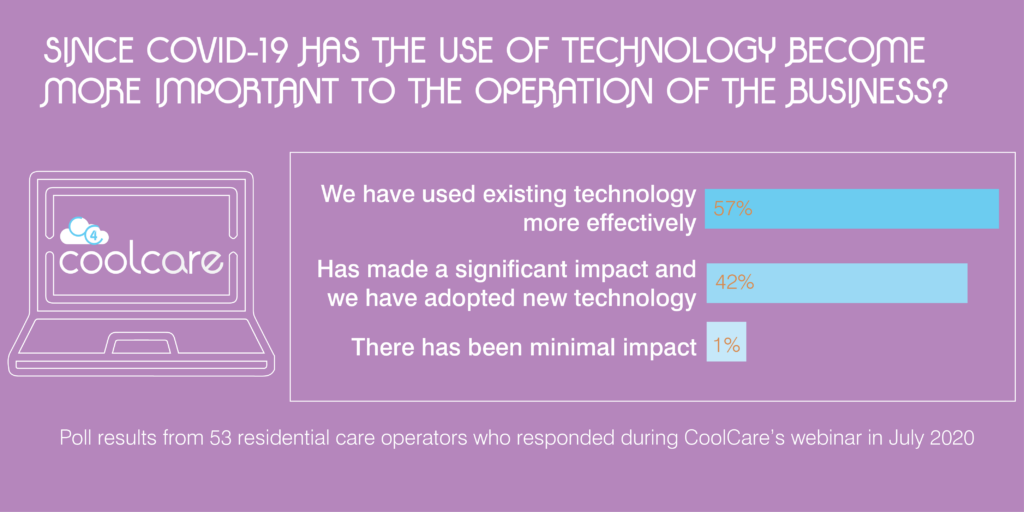

Poll #2 Answers

the role of technology.

Technology has been instrumental in allowing businesses to make data-driven decisions with live data fuelling conversations and actions. It is, perhaps, as we begin to review our experiences that we can fully appreciate the role that technology has played in getting us all through the lockdown.

Technology has been instrumental in allowing businesses to make data-driven decisions with live data fuelling conversations and actions. It is, perhaps, as we begin to review our experiences that we can fully appreciate the role that technology has played in getting us all through the lockdown.

Since the outbreak of COVID19, 98% of the care home operators we asked said they have either adopted new technology or used existing technology as an important operation of their business. The crisis has clearly given the impetus that many providers needed to digitalise their operations, with many of them turning to technology during lockdown.

This sentiment was supported by all the panellist throughout the discussion. From an operational perspective, Matt, AK and Mike all reported making significant gains and efficiencies from the systems they already have – finding datasets they never even knew they had, to help inform their business planning.

Already an early adopter and proponent of care home software adoption, Matt’s view on the need for tech was further cemented through the crisis: “Quite honestly, I am not sure how on earth we would have coped without [digital systems] in the environment that we’ve just been in with the number of homes that we have”. AK strongly supported this view, elaborating on how Country Court Care was gaining more value out of their pre-standing tech by “using things that we already had a lot more efficiently, we track a lot of KPIs and I’d say that the systems we had to pull that data made it a lot easier”

Mike was particularly emphatic about the importance of digital systems to his business, and how important the decision was to put the right systems in place given the way they use data across the organisation: “Halcyon relies on data for every decision that we make… We like to justify the decisions that we make based on the data, [and] with CoolCare, for example, one of the important things for us is being able to review clocking in and clocking out. We’ve then taken that further and are reviewing care hours worked Vs. the budgeted hours and being able to track those efficiencies of staff, clearly and at a touch of a button”.

Mike was particularly emphatic about the importance of digital systems to his business, and how important the decision was to put the right systems in place given the way they use data across the organisation: “Halcyon relies on data for every decision that we make… We like to justify the decisions that we make based on the data, [and] with CoolCare, for example, one of the important things for us is being able to review clocking in and clocking out. We’ve then taken that further and are reviewing care hours worked Vs. the budgeted hours and being able to track those efficiencies of staff, clearly and at a touch of a button”.

The discussion made it clear that technology such as CoolCare enables systems and processes which can easily be maintained remotely and supports the team when their environment is changing on a daily basis. The ability to monitor staff shifts and sickness, training and invoicing remotely has been invaluable to operators, mitigating against staff sickness and providing the ability for management to not need to visit in person, with occupancy, agency staff costs and invoicing taken care of quickly. Also, with infection control of paramount importance, the ability to operate management systems as normal without touching and sharing paperwork has been instrumental in reducing touchpoints and the risk of transmission between staff.

From an investor point of view, John reflected that there was a marked difference in how the different operators Target works with had been able to utilise technology and the difference that made to their ability to react to COVID19. Whilst some were “really hot” on tech at the start, and therefore able to provide solid KPIs and real-time updates from the start, others found new abilities in the systems they already had which saw the quality of their MI improve over the weeks.

He shared that, “there are still some providers that are really relying on walking the floors and observing, who have found it more challenging when homes are locked down and management aren’t able to visit on site. It has highlighted to many who were resistant in adopting the tech previously, that they need to take the next step as we’ve found that those who were on top of running their business remotely have navigated recent difficult times a little better.”

AK added further that tech was going to be really important for promoting the homes as part of the huge marketing exercise that is going to be needed to increase confidence in the sector as good use of tech will be a differentiating factor when families look to place a loved-one.

funding and investment.

The panel turned their attention to the investment markets which are the life blood behind any growing operator’s expansion plans.

Head of investment John Flannelly struck a positive tone, opening the discussion by sharing his perception of care homes compared to other asset classes: “…[If] you consider the other different real estate asset classes that the institutions invest in, lots of these have much more challenging futures … Retail and office investments markets are facing a very uncertain future at the minute [whereas] our businesses are ‘needs-based’ so of our properties were occupied throughout and have fulfilled a critical role during the last 3-4 months, whereas many asset classes were empty.”

Head of investment John Flannelly struck a positive tone, opening the discussion by sharing his perception of care homes compared to other asset classes: “…[If] you consider the other different real estate asset classes that the institutions invest in, lots of these have much more challenging futures … Retail and office investments markets are facing a very uncertain future at the minute [whereas] our businesses are ‘needs-based’ so of our properties were occupied throughout and have fulfilled a critical role during the last 3-4 months, whereas many asset classes were empty.”

His view was that this will lead to a continued trend in capital moving from more traditional asset classes to more people-based assets like care homes. The clear attraction to those investors will be the quality of the asset itself, and in reference to the early discussion, the design’s ability to support an operator through further outbreaks.

The optimism in the medium to long term was shared across the panel. Matt added that LNT Care Developments had actually seen a spike in interest in new build facilities over the preceding months. He felt there was a lot of investment waiting to come into the market, and whilst it has been extremely difficult for the sector, it has faired well in comparison to other sectors overall because of the demand profile.

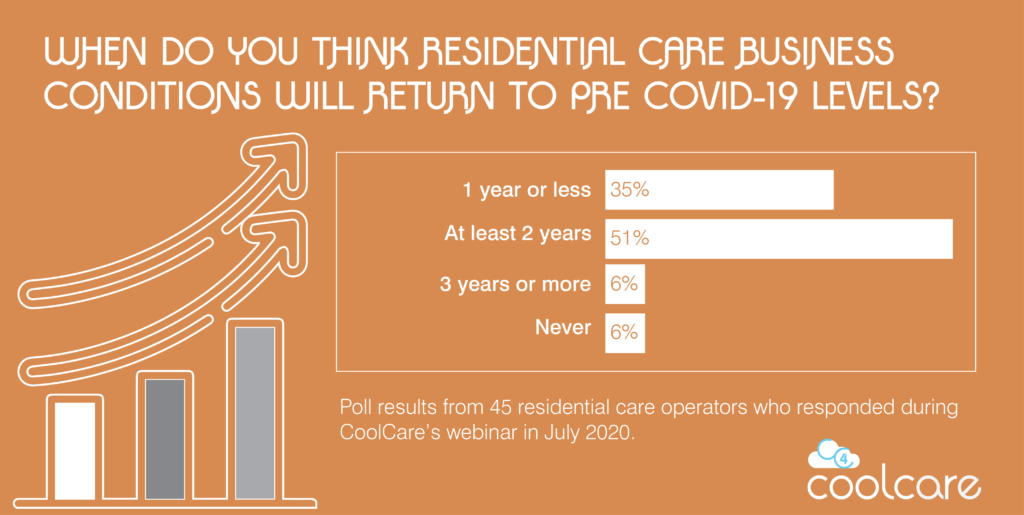

Poll #3 Answers

rebuilding consumer confidence.

With the majority of care home operators anticipating that it will take at least two years for residential care business conditions will return to pre-COVID 19 levels, care homes may have a lot of reputation management to take care of. Communicating the extra measures that have been adopted will go a long way to reassure residents, relatives, stakeholders and investors that safety is paramount. Working together as an industry, this could be a very powerful way to ‘repair’ industry reputation. In their concluding thoughts, the panel gave their views on how the sector can go about regaining confidence.

AK emphasised the need for care home operators need to be shouting about what they’re doing and used the example of “…sharing the results of testing and the number of tests that have been done, it’s just a figure but it gives a confidence that testing is happening”.

AK emphasised the need for care home operators need to be shouting about what they’re doing and used the example of “…sharing the results of testing and the number of tests that have been done, it’s just a figure but it gives a confidence that testing is happening”.

Mike noted the need to rebuild reputation at a national level via national representative bodies who can challenge the Government work to secure policy changes which will safeguard the sector. In particular, he pushed for a long term funding solution, concluding that doing so “will change the perception of the industry – that we are not all out to take elderly people’s money from them and are there to provide care.”

Matt Lowe focused on the need to engage with internal and external audiences openly. In Ideal Carehomes, for example, “we’ll put messaging up on our CoolCare Virtual Notice Boards so when people come in they can see exactly what we are doing to keep people safe via infection control…”

Finally, John supported the comments made by the previous panellists, stressing the need to give confidence about not just the care of a loved-one, but the ability to visit them safely once they have moved in. The future of the sector will be based on how well we are able to respond to those questions, “People are now far more knowledgeable about care homes, there will be a lot more questions about how you evidence what you are doing.”

There are grounds for optimism across the wider care home sector – care homes play a critical role in society and, unlike retail and hospitality, it’s perhaps escaped the worst of the financial impact. This won’t be lost on investors and evidence shows a spike in interest for new builds and an increase in the volume of enquiries. With a sense that there is investment waiting to flood the market, things could look bright for the sector.

moving forward.

The care home industry is facing some changes – and these can be reduced down to practical ‘things-to-do’. In some cases. Care home management, policies and procedures have long been driven by a commitment to quality of care, but infection management is now of equal importance.

It is a unique opportunity for the industry to emerge with a fresh, new narrative for a more engaged audience, driving home the point that care homes are about care, concern and support and are safe-spaces for a loved one to move into.