Every year, care homes experience predictable spikes in enquiries. Whether it’s following the festive season, school holidays or simply a change in family circumstances, certain times of year trigger more families to explore care options for their loved ones.

For care providers, these seasonal uplifts present an opportunity but only if you’re ready to respond. With over half of prospective residents needing placement within a month and many within just a week, speed and consistency are key.

Here are four smart ways to ensure your care home makes the most of every enquiry, turning interest into admissions with confidence and clarity.

speed up your response time.

When families reach out, they’re often juggling emotion, logistics and urgency all at once. A quick, reassuring response shows you’re not just available, you’re ready to help.

Strong enquiry handling is about structure as much as speed. Clear ownership of enquiries, consistent follow-up points and visibility across teams all help ensure prospective residents move confidently through the admissions journey.

With CoolCare’s enquiry management tools, every interaction is logged in one place. Teams can see enquiry status in real time, pick up conversations seamlessly and maintain a consistent experience for families helping turn initial interest into confirmed admissions without opportunities slipping between teams or systems.

use live occupancy data to act quickly.

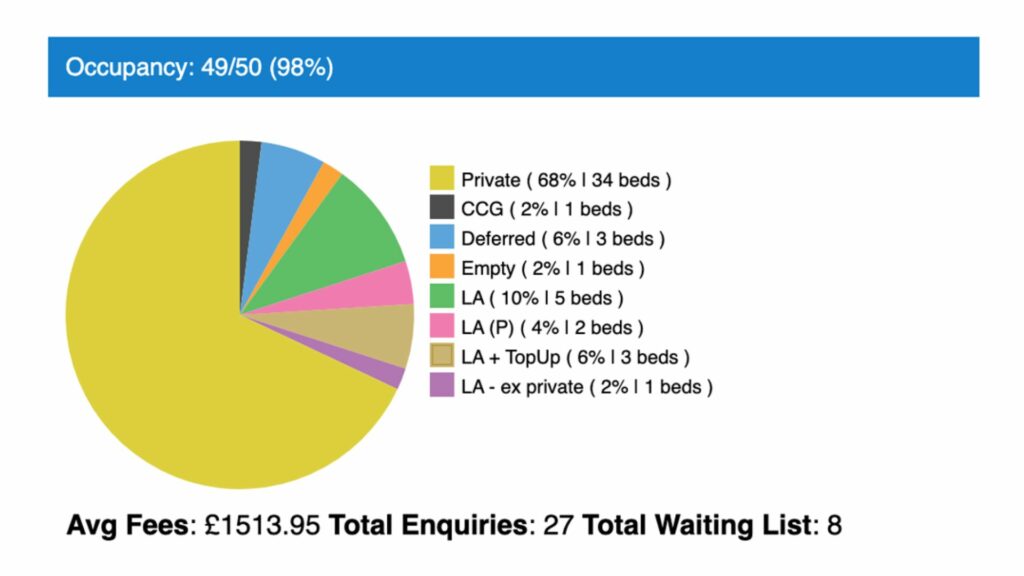

The ability to say “yes” confidently depends on knowing your room availability, right now!

CoolCare’s live occupancy dashboards show you exactly what’s available, pending or due to become free. This helps your team give immediate, accurate answers and move forward with admissions without unnecessary back-and-forth or delay.

Live data removes the guesswork, making your decision-making faster, clearer and more reliable for families in need.

make a lasting first impression.

That first visit matters. It sets the tone for the whole experience.

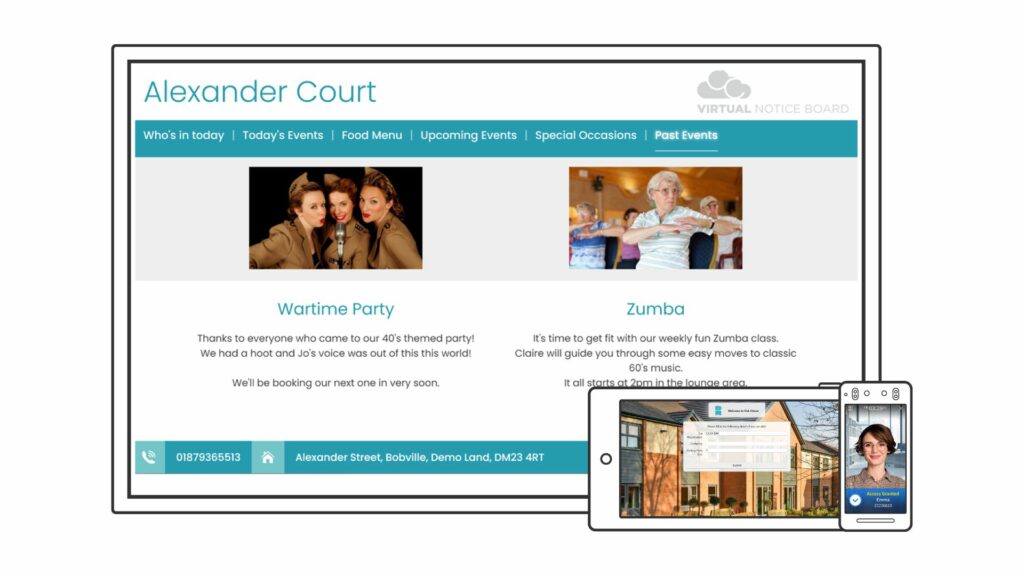

With CoolCare’s Connected Reception, your care home front-of-house becomes smarter, smoother and more welcoming. Digital visitor books, biometric staff sign-ins and virtual noticeboards showing menus, birthdays and staff on duty all help create a professional, people-first impression.

And when families see technology in action, they see a home that’s organised and transparent – everything they want for their loved one.

turn every enquiry into a tracked opportunity.

Enquiries that don’t get followed up quickly are often lost. Not because the family wasn’t interested but because another provider got back faster, with more clarity.

CoolCare gives your admissions team complete oversight. You’ll know where each enquiry came from, who responded, what was said and what next step is needed. This kind of visibility ensures better conversion rates, better marketing ROI and less stress for your team.

Ready to make 2026 your most efficient admissions season yet?

The New Year spike is no surprise – it’s a pattern. And with the right systems, your care home can be ready for it.

CoolCare helps you respond faster, manage occupancy smarter, and impress families from the first click to the final decision.

Let’s turn seasonal interest into sustainable growth.To discover how a smarter front-of-house can elevate your visitor experience and streamline daily operations, read our blog on introducing connected reception: transforming the care home experience.

There are no posts matching your criteria.